What I’ve learned about Time and Timing during my 22 years as a Financial Advisor

By: John Roland

Published: October 2020

2020 will be remembered for many things, most of which it seems we wish we could forget. For me, it marks 22 years as a Financial Advisor with Northwestern Mutual and it’s been a great ride thus far. As I reflect on my career as a Financial Advisor, particularly now amid a global pandemic, two words come to mind: time and timing. Let me explain.

Clients often ask, “Is now a good time to invest?” Seems straightforward enough, but I suspect what they’re really asking is, “If I invest now, will I have lost money when I need to spend it?” Or, put another way, “Will the money be there in the future to achieve the objective for which it’s intended?” Their concern is about investing ‘now’ versus at some point that *might* be better in the future.

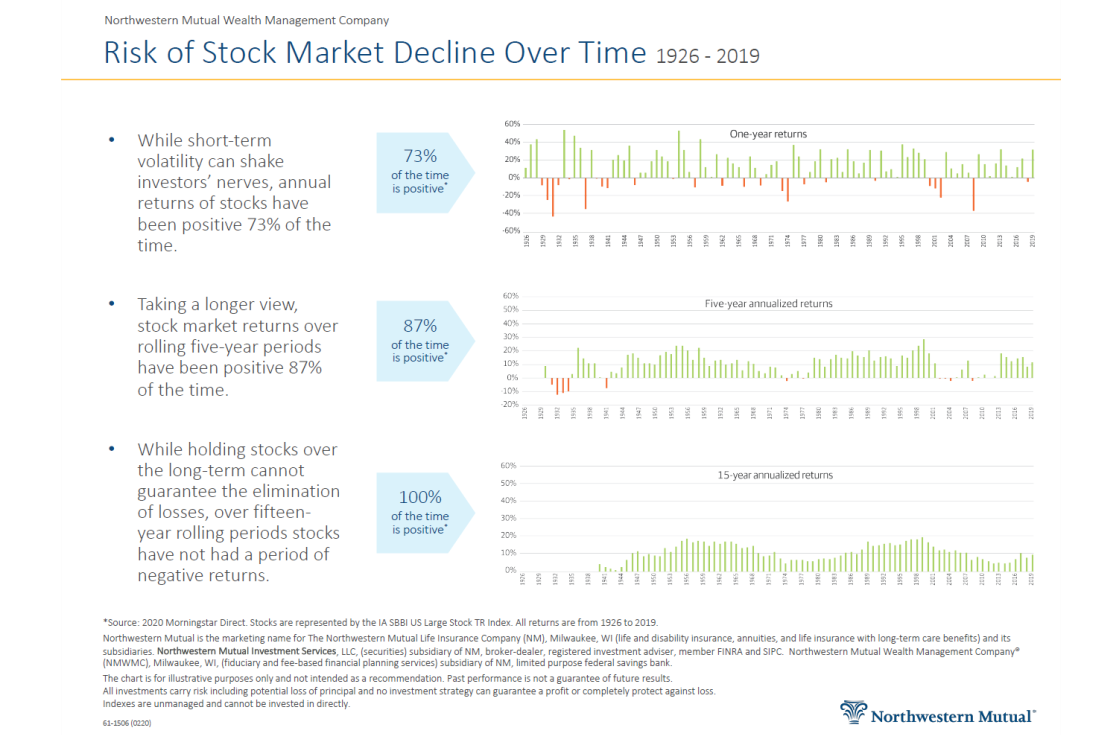

This is where the idea of time comes in. The graphs below demonstrate the year-over-year returns of US Large Cap stocks since 1926. You’ll notice that the longer you held your investment, the better the outcome:

-

On a 1-year calendar basis, 73% of the time the result was positive, meaning 27% of the time it wasn’t—about a 1 in 4 chance that you would have lost money if your timeframe for withdrawing the funds was only one year.

-

On a 5-year rolling time period, 87% of the time the return was positive, 13% negative. That equates to about a 1 in 8 chance you would have lost money if your timeframe for withdrawing your original investment was 5 years.

-

On a 15-year rolling time period, 100% of the time the returns were positive if you stayed invested the entire time. (More on this point in a moment).

This means that if you were investing for the longer term, then you would have been best served to have your money invested for the entire duration of that longer term.

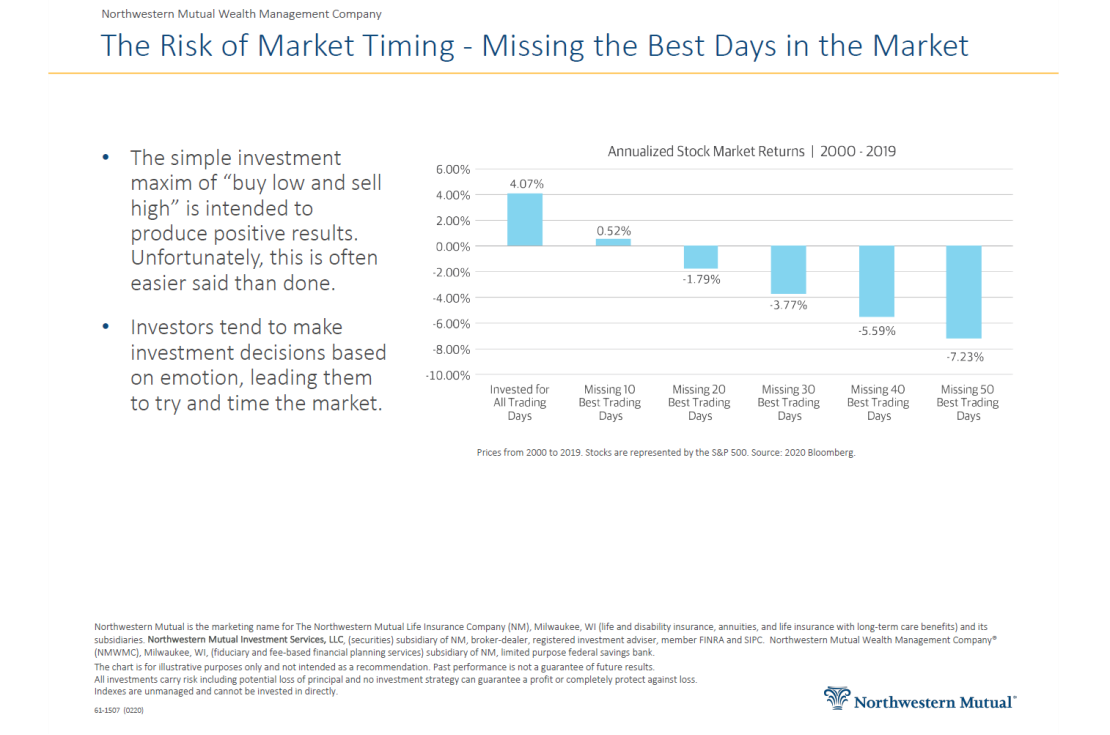

This brings me to my second point, timing. You see, those returns over the course of time don’t happen consistently. Every day, month, quarter, and year is different. Interestingly, the returns over longer periods of time boil down to a just a few key days. You may be familiar with the Pareto Principle, which states that roughly 80% of the effects come from 20% of the causes, sometimes referred to as the “80/20 Rule.” But when it comes to market returns, it’s like the Pareto Principle on steroids!

To that point, below is one of the most eye-opening pieces of information I’ve seen in my career. This data shows that just 20 days out of the last 20 years determines the difference between a gain or a loss. That’s 20 days out of 5031. Put differently, less than one half of one percent, (0.4% to be more precise), of the total trading days accounted for ALL the return—and then some--over two decades of market growth.

If you had been invested every day over the 20 years from 2000 through 2019, you would have realized an average 4.07% return per year. Had you missed just the best 20 days over those 20 years, your performance would have resulted in an average -1.79% return (notice the negative sign). Put into real dollars:

-

If you had $100,000 on January 1st, 2000, with an annualized rate of return of 4.07%, on December 31st, 2019, your account value would have been $222,080.

-

If instead you had been out of the market on just those 20 critical days, your $100,000 investment would have been worth $69,680. This would have been a costly mistake that had a real impact on achieving your financial goals.

And something else to remember: during the 20 years highlighted, we experienced a market loss of more than 44% from September 2000 through September 2002, and a loss of more than 50% from November 2007 through February 2009—what a roller coaster ride!

Realistically, the chance that my clients and I are going to be able to accurately predict when the perfect time to invest funds into the stock market is practically zero. Sure, we can say that markets may be overvalued or undervalued relative to previous periods of time, and there’s always a current event that suggests “this time is different.” However, over the past 20 years, as well as since 1926, there have been times of market overvaluation and undervaluation along with very challenging national and global events. Yet, had you invested at any point and kept your money in long enough, you would have seen your money grow. While experiencing market losses from time to time, some of which can be severe and can be nerve-wracking, I believe the greater risk to your long-term financial security is missing out on the 0.4% “best days” and foregoing 20 years’ worth of market growth by trying to ‘time’ the market.

When I think about stock market performance so far this year, I’m more convinced than ever that trying to pinpoint the precise “right” moment to invest is an impossible game to win. The best way to set yourself up for investment success is to be diversified, hold for the long term, and not panic during market downturns. “Stay the course” isn’t just a phrase we like to use as financial advisors to calm our clients during market drops, it’s the best way to assure yourself of a lifetime of positive returns.

THE OPINIONS EXPRESSED ARE THOSE OF JOHN ROLAND AS OF THE DATE STATED ON THIS MATERIAL AND ARE SUBJECT TO CHANGE. THERE IS NO GUARANTEE THAT ANY FORECASTS MADE WILL COME TO PASS. THIS MATERIAL DOES NOT CONSTITUTE INVESTMENT ADVICE AND IS NOT INTENDED AS AN ENDORSEMENT OF ANY INVESTMENT OR SECURITY. PLEASE REMEMBER THAT ALL INVESTMENTS CARRY SOME LEVEL OF RISK, INCLUDING THE POTENTIAL LOSS OF PRINCIPAL INVESTED. INDEXES ARE UNMANAGED AND CANNOT BE INVESTED IN DIRECTLY. RETURNS REPRESENT PAST PERFORMANCE AND ARE NOT A GUARANTEE OF FUTURE PERFORMANCE. DIVERSIFICATION DOES NOT ASSURE PROFIT OR PROTECT AGAINST LOSS. JOHN ROLAND IS A FINANCIAL ADVISOR WITH THE NORTHWESTERN MUTUAL WEALTH MANAGEMENT COMPANY.